Protecting Your Pharmacy from Fraudulent Electronic Prescriptions

Preventing Electronic Prescription Fraud

Recently, PAAS National has assisted pharmacies in dealing with fraudulent electronic prescriptions stemming from compromised prescriber credentials. Earlier this year, a significant e-prescription fraud incident saw criminals issuing over 18,000 fake prescriptions to pharmacies across 18 states within just five hours.

Financial Repercussions and Mitigation

Fraudulent prescriptions billed to insurance can lead to full recoupment during PBM audits. Pharmacies must cooperate with PBM audits and demonstrate their “due diligence” in verifying prescriptions to avoid being considered willing participants. To mitigate financial losses from PBM recoupments, pharmacies may need to rely on business insurance or pursue legal action against the fraudsters.

Proactive Measures for Prevention

While electronic prescriptions are generally safer than their written or telephone counterparts, they are not immune to criminal exploitation. Here are some strategies to identify fraudulent electronic prescriptions at your pharmacy:

1. Familiarize Yourself with the Prescriber

- Is the prescriber new to your area?

- Have you previously received prescriptions from this prescriber?

- Is the prescribed medication within their scope of practice?

- Can you verify the prescriber’s details (e.g., phone number, address) through public resources?

2. Know Your Patient

- Is the patient new to your pharmacy?

- Does the patient reside within your service area?

- How was the prescription insurance information obtained?

- Consider requiring a photo ID for prescriptions picked up by new patients.

- Be cautious if all interactions are through a friend or family member.

3. Scrutinize the Prescription for Anomalies

- Is the dosage regimen unusual?

- Does the patient have a valid reason for using the medication?

- Does the patient have other prescriptions from this prescriber? Can the patient confirm treatment by this prescriber?

- Are there multiple prescriptions for high-cost brand medications, especially those dispensed in their original containers?

By implementing these measures, you can better safeguard your pharmacy against fraudulent electronic prescriptions and avoid the associated financial and legal repercussions.

MGMT Tips:

- Reversing and “cashing out” discount card Record your due diligence efforts either on the prescription itself or within your pharmacy management software.

- Report fraudulent prescriptions to the prescriber, local law enforcement, the board of pharmacy/medicine, and the PBM.

- Reach out to your business insurance provider, as they might offer solutions to help manage fraud-related losses.

New Dispense as Written (DAW) Code Introduced

You’re likely familiar with DAW codes 1, 2, or 9. Pharmacy staff generally know that DAW 1 is used when the prescriber prohibits generic substitution for a multi-source brand, DAW 2 when the patient requests the brand name, and DAW 9 when the insurance plan prefers the brand name product. These rules also apply to biologic reference products, such as Lantus, with interchangeable biosimilars like Semglee.

However, real-world claim adjudication can be more complex. For example, a patient with both a commercial primary insurance and Medicaid as secondary might face conflicting preferences, with one payor favoring the brand and the other the generic.

To address such scenarios, the National Council for Prescription Drug Programs (NCPDP) has introduced its first non-numeric DAW code. The new alpha code, DAW A, is included in the NCPDP Telecommunication Version D and

Above Questions, Answers, and Editorial Updates (Version 65, May 2024). DAW A is used for multi-payor claims, indicating to one payor that another payor requires the multi-source brand or reference product (with an interchangeable biosimilar) to be dispensed.

For claims:

- Use DAW 9 for the payor requiring the multi-source brand/reference product, regardless of whether it’s the primary or secondary payor.

- Use DAW A for the other payor that does not require the multi-source brand/reference product, again regardless of its status as primary or secondary.

Using the DAW A code allows the payor that does not require the multi-source brand/reference product to either accept the claim with the associated brand pricing rules or reject it as 70: Product/Service Not Covered – Plan/Benefit Exclusion.

MGMT Tips:

Documentation: Ensure there is appropriate documentation on the hardcopy or within the prescription record to indicate which plan required the brand and which did not for any DAW code other than 0.

Common Scenario: When Medicaid is the secondary payor and requires the brand/reference product, but the primary payor does not, follow these steps:

- Submit the claim for the generic drug using DAW 0 to the primary payor for a paid claim with a non-$0 patient copay.

- Continue billing and submit the claim for the generic drug using DAW 0 to Medicaid (secondary).

- Medicaid will reject the claim as 606-Brand Drug/Specific Labeler Code Required.

- Reverse the claim and resubmit the multi-source brand/reference product to the primary payor with DAW 9. They should reject with 22: M/I DAW Code, and if the pharmacy continues and bills to Medicaid (secondary), Medicaid may reject the claim as 6E: M/I Other Payor Reject Code.

- Bill the claim to the primary payor for the multi-source brand/reference product with DAW A (Multi-Payor Brand/Reference Product Formulary Conflict). The primary payor should accept the claim and apply brand pricing.

- Continue to bill the multi-source brand/reference product to Medicaid as the secondary payor with DAW 9.

Auditors Are Attracted to Santyl® Like Insects to Light

As summer arrives, so do the bugs! Though mosquitos, gnats, and moths have little to do with Santyl® ointment, used for debriding chronic dermal ulcers and severe burns, the analogy of auditors flocking to Santyl® claims like insects to light is quite fitting.

Pharmacies submitting claims for Santyl® ointment should expect future audits. The manufacturer provides a specialized online calculator (https://Santyl.com/hcp/dosing) to ensure proper dosing and dispensing. For chronic wounds, prescriptions must detail the wound’s length and width (in centimeters) and treatment duration. For burns, the total body surface area and number of applications are required.

Missing these measurements flags prescriptions as non-calculable, leading to full recoupment. Auditors focus on these high-value claims because prescribers and pharmacy staff often omit the necessary details, resulting in failed audits.

Example Wound Calculation:

Wound dimensions and therapy duration: 6 cm x 2 cm for 30 days

Manufacturer calculator: Recommends 90 g tube (total 62 g needed)

- 90 g tube calculation:

-

- 1.78 cm = 1 g

- 90 g x 1.78 cm/g = 160.2 cm

- 160.2 cm / 3.6 cm per application = 44.5 days’ supply

- 30 g tube calculation:

- 3.04 cm = 1 g

- 30 g x 3.04 cm/g = 91.2 cm

- 91.2 cm / 6.2 cm per application = 14.7 days’ supply

- Two 30 g tubes = 29.4 days’ supply

Another common issue with Santyl® ointment claims is the online calculator’s rounding, which can cause incorrect days’ supply billing. The calculator rounds up to the nearest tube size (30 or 90 grams). Therefore, pharmacies must calculate the true days’ supply to avoid dispensing excess medication.

Auditors Are Attracted to Santyl® Like Insects to Light (cont..)

MGMT Tips:

- Set Up Reminders in Pharmacy Software:

- Flag the 30 g (NDC 50484-010-30) and 90 g (NDC 50484-010-90) tubes of Santyl® ointment in your pharmacy system to remind staff to check the prescription for wound length and width (in centimeters) and treatment duration.

- Document Measurements for Multiple Wounds:

- Ensure that measurements and treatment duration are documented for each wound if more than one is being treated.

- Reevaluate Wound Measurements Periodically:

- As therapy progresses and the wound size decreases, periodically reassess the wound measurements.

- Contact the prescriber’s office to obtain a new prescription if the wound size changes.

- Enter the new measurements into the Santyl® online calculator and adjust the quantity and days’ supply accordingly.

- Note: The Santyl® calculators have a 30-day maximum duration to emphasize the need for regular wound reassessment.

- Treating Burns:

- Use the Santyl® manufacturer’s online calculator exclusively for determining the appropriate quantity for burns.

- Remember to back-calculate the correct days’ supply by following the outlined method

Ensuring Audit Readiness: Key PBM Requirements for Signature Logs and Proof of Delivery

A common concern for pharmacies is understanding the audit requirements for signature logs. This article outlines critical reminders and requirements that auditors focus on to help ensure your pharmacy is prepared.

With the conclusion of the Public Health Emergency on May 11, 2023, PBM waivers for signature collection and mailing allowances were largely rescinded, except for Humana, which extended its mailing waiver until December 31, 2023. It is essential for pharmacies to remind all staff to collect signatures at the time of prescription pickup and delivery. Non-compliance could result in significant audit recoupments and a cumbersome appeals process.

During the Public Health Emergency, both pharmacies and patients grew accustomed to the absence of signature requirements for prescription pickups and the convenience of mail or delivery services. However, it is now crucial to educate patients about their insurance requirements, despite the potential difficulty in communication.

Major PBMs such as Caremark, Humana, OptumRx, and Express Scripts allow prescription deliveries, but with specific restrictions. These limitations are often found in pharmacy contract agreements rather than provider manuals.

Key delivery restrictions by two of the largest PBMs include:

- OptumRx: According to the Pharmacy Provider Manual, deliveries must be conducted by a pharmacy’s W-2 employee within a 100-mile radius. The use of common carriers, including USPS, is prohibited.

- Caremark: The Pharmacy Provider Manual specifies that pharmacies delivering more than 20% of monthly claims via common carriers, including USPS, are not classified as “Retail Pharmacies.”

MGMT Tips:

- Signature Requirement: Ensure staff collect signatures for all in-store pickups and deliveries.

- Log Details: Include the date received in signature and delivery logs.

- No Proxy Signatures: Staff and drivers cannot sign for patients.

- Photo Evidence: Photos or “authorization” to leave deliveries are not accepted in PBM audits.

- Tracking Links: Ensure prescriptions are linked to tracking information when using common carriers.

- Keep Tracking Data: Maintain access to tracking information for audits.

- Out-of-State Compliance: Adhere to licensure requirements for out-of-state deliveries.

Audit Tactics and Tips Diabetic Test Strip Authorized Distributors

Independent pharmacies are frequently receiving threatening letters from LifeScan and an affiliated law firm. These letters claim that pharmacies have submitted more claims for LifeScan’s OneTouch diabetic test strips to PBMs than their purchase history from authorized distributors supports. This is essentially a covert “invoice audit,” and pharmacies only become aware of it when they receive negative results.

The letters also threaten to withhold rebate dollars owed to PBMs and inform PBMs of the pharmacy’s “non-compliance” unless a substantial payment is made to resolve the issue.

Pharmacies often seek to lower their costs to either make a small profit or minimize losses, given that PBMs control the selling price of insured claims. However, this approach can be problematic when trying to adhere to PBM contractual requirements and ensuring that products obtained are legitimate.

Diabetic test strips, classified by the FDA as OTC medical devices, are not covered by the Drug Supply Chain Security Act (DSCSA). This means there is no requirement for a “pedigree” to verify that the products are legitimate and not stolen, counterfeit, or previously dispensed (gray market). Pharmacies must be cautious when sourcing products advertised at lower costs than their primary wholesaler. Manufacturers maintain “lists” to help supply chain partners like pharmacies.

Understanding PBM requirements is crucial. While OptumRx does not explicitly require pharmacies to purchase test strips from authorized distributors, it does mandate that pharmacies source all products from vendors licensed as drug wholesalers in the state and accredited by NABP. Both Caremark and Express Scripts require network pharmacies to purchase test strips only from authorized distributors.

Additionally, California and New Jersey have specific regulations regarding the purchase and distribution of OTC diabetic test strips.

MGMT Tips:

- Carefully navigate the intersection of state pharmacy regulations, PBM contract requirements, and manufacturer distribution channels when making inventory purchases. Opting for the lowest price might lead to non-compliance issues.

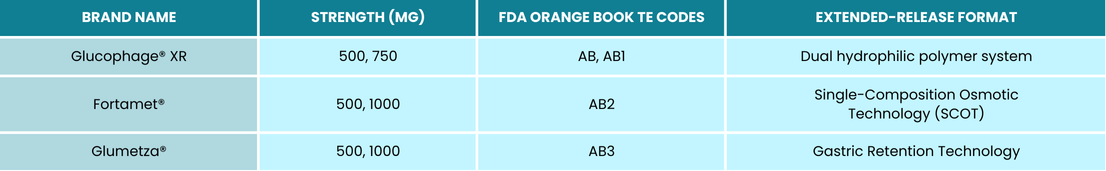

Metformin HCl ER – Audit Considerations

Metformin HCl ER is used alongside diet and exercise to improve glycemic control in adults with type 2 diabetes mellitus, particularly for patients who experience gastrointestinal side effects from the non-ER version. However, its higher cost, especially for brands like Glumetza® or Fortamet®, increases the likelihood of audits.

Adding to the complexity, there are three distinct versions of metformin HCl ER, each with a different extended-release mechanism. These versions are not interchangeable and have unique Therapeutic Equivalency (TE) codes, indicating which generic products can be substituted for specific brand names. When multiple branded versions of the same active ingredient, form, and route of administration exist, the FDA assigns additional identifiers such as AB, AB1, AB2, and AB3 to distinguish them.

You may only dispense a generic formulation of the above if the TE code matches.

MGMT Tips:

- Justify High-Cost Medications: Dispensing expensive medications without lower-cost alternatives can trigger PBM audits. Auditors may request prescriber clarification.

- Document Clinical Reasons: When switching a patient to metformin HCl ER due to side effects, note the rationale on the prescription.

- Limit Bulk Switching: Switching many patients to metformin HCl ER may attract audits and accusations of solicitation.

- Clarify Generic Prescriptions: Confirm with the prescriber which metformin HCl ER version is preferred and document the conversation.

- Get Approval for TE Code Substitutions: For substitutions between versions with different TE codes, obtain and document prescriber approval.

- Use FDA Orange Book: Identify TE codes using the FDA Orange Book (https://www.fda.gov/drugs/drug-approvals-and-databases/approved-drug-products-therapeutic-equivalence-evaluations-orange-book).

2024 Self-Audit Series: Topical Prescriptions

Topical medications are prime targets for audits, especially given their increasing costs. A common issue cited is “non-calculable instructions,” meaning the PBM believes the pharmacy cannot accurately bill the days’ supply based on the prescription’s instructions. Pharmacies will need additional information, typically a prescriber’s statement, to appeal these findings.

Pharmacies must ensure accurate billing by verifying prescription details. Prescriptions specifying the number of grams per application and frequency can be billed accurately. Clarify vague instructions with the prescriber and document this clarification both on the prescription and the patient’s label, as required by OptumRx.

Do not rely on the days’ supply field in electronic prescriptions, as PBM auditors do not accept this. Prescriptions with a quantity of “1” are often flagged for “incomplete quantity.” Auditors require a specific quantity in grams, milliliters, or pumps. Thorough verification and documentation can help prevent audit recoupments.

MGMT Tips:

- Staff Training: Ensure staff are trained to review topical prescriptions for complete and clear instructions before filling.

- Frequent Self-Audits: Regularly self-audit expensive topical prescriptions to confirm instructions are sufficient for passing audits.

- Fill on Request Only: Dispense topical medications only upon patient request.

- Detailed Clinical Notations: Clinical notes must include the date, the name and title of the person you spoke with, the details clarified, and your initials.

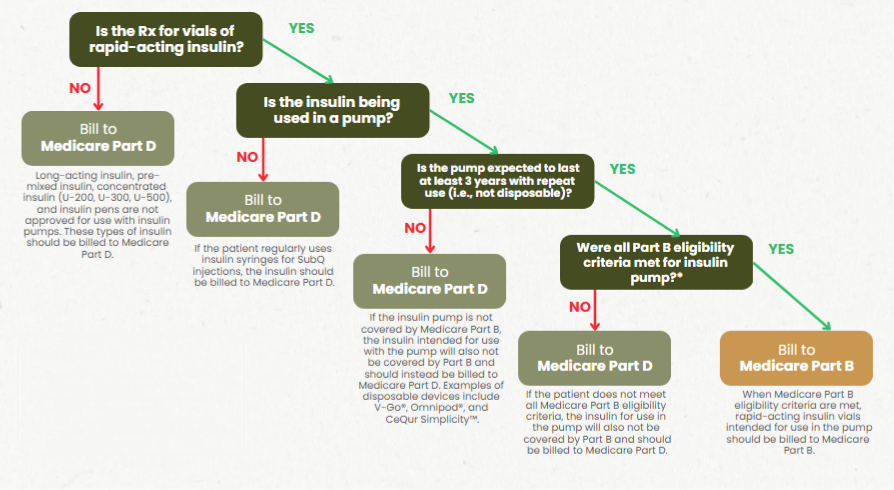

Insulin for Use in a Pump – Keep Your Earnings Out of the PBM’s Pocket

Considerations for Billing Insulin Vials: Medicare Part B vs Part D

Adding to the complexity, there are three distinct versions of metformin HCl ER, each with a different extended-release mechanism. These versions are not interchangeable and have unique Therapeutic Equivalency (TE) codes, indicating which generic products can be substituted for specific brand names. When multiple branded versions of the same active ingredient, form, and route of administration exist, the FDA assigns additional identifiers such as AB, AB1, AB2, and AB3 to distinguish them.

MGMT Tips:

- Even if the pharmacy is unable to bill insulin to Medicare Part B, this determination must still be made to prevent chargebacks.

- If the patient has a Medicare Advantage plan, the insulin should be billed to that plan.

When billing insulin vials for use in a pump for Medicare-eligible patients, it’s crucial to determine whether to bill Medicare Part B or Part D. Follow a flowchart with four key questions to identify the correct payor.

Insulin for Use in a Pump – Keep Your Earnings Out of the PBM’s Pocket (cont..)

MGMT Tips:

- Only rapid-acting insulin is FDA-approved for use in pumps.

- Long-acting, pre-mixed, and concentrated insulins are NOT approved for use in pumps.

- There are two types of insulin pumps:

- Disposable (tubeless) pumps such as V-Go, Omnipod, and CeQur Simplicity™

- These do not meet Medicare Part B requirements and should be billed to Part D.

- Durable (tubed) pumps

- These are covered by Medicare Part B if eligibility criteria are met.

- Disposable (tubeless) pumps such as V-Go, Omnipod, and CeQur Simplicity™

- When receiving a prescription for insulin vials, PAAS recommends the following steps:

- Determine if the patient is Medicare eligible.

- Confirm whether the prescription is for rapid-acting or long-acting insulin.

- Verify if the patient is injecting insulin or using it in a pump.

- Identify the type of insulin pump the patient is using (durable or disposable).

- If it is a durable pump, ensure the patient meets Medicare Part B eligibility criteria.

- Medicare Part D plans typically do not reject insulin claims at the point of sale, so these must be monitored.

- Even if your pharmacy is not enrolled as a Medicare Part B supplier, you must still know how the patient is using their insulin, as this determines which Medicare benefit is responsible for payment.

- Check out the Insulin Flow Chart from MGMT for further guidance.

2024 Self-Audit Series: Topical Prescriptions

Below is a list of drugs reviewed and analyst comments compiled from the first six months of 2024 for comparison.

Top 5 Drugs Reviewed: 2024 (January-June) vs. 2023 (January-December)

|

January-June 2024 |

January-December 2023 |

|

Ozempic® |

Lantus® |

|

Nurtec® |

Humalog® |

|

Mounjaro® |

Creon® |

|

Creon® |

Levemir® |

|

Ubrelvy® |

Invega® |

While Creon® remains a significant target for PBMs, the first half of 2024 shows a shift in focus from insulin claims to GLP-1s and migraine medications. This shift highlights the evolving trends in PBM audits. Despite this change, insulin claims reviews are still prevalent. Although they don’t appear in the top five for 2024 so far, Tresiba®, Humalog®, Levemir®, insulin lispro®, and Toujeo® closely follow Ubrelvy® in the number of claim reviews issued by PBMs to date.

Top 5 Analyst Comments After Claim Reviews (Consistent with 2023):

- Document the Reason for Cut Quantity: Auditors need to know why the pharmacy dispensed less than what was prescribed.

- Black Out Acquisition Cost and Profit Margin on the Backtag.

- Clinical Notation Requirements:

- Date

- Name and title of the person you spoke with

- Confirmation details

- Pharmacy employee initials

- No Backtag/Sticker Attached: Typically requested by PBMs and useful for Auditors to review billing elements.

- Verify and Document Prescribed Quantity: Ensure the Unit of Measure (UOM) is specified and appropriate for the medication ordered, and make a clinical notation on the hard copy.

The Impact of 28-Day Supply vs. 30-Day Supply Fills

Navigating the world of prescriptions can be complex, particularly when understanding the nuances between different days’ supply schedules. For many prescriptions, the distinction between a 28-day supply and a 30-day supply can significantly impact your audit results.

Weekly medications are typically prescribed to be taken once every seven days, meaning a 28-day supply covers four weeks of treatment.

Monthly medications are generally prescribed to be taken once every 30 days, ensuring patients receive one dose per month, aligning with their treatment schedules.

Understanding these differences is crucial as they can influence your audit outcomes.

Examples of Correct Billing for 28-Day and 30-Day Supplies:

|

Medication |

Quantity |

Dosage |

Billing |

|

Invega Sustenna 234 mg/1.5 mL |

1 syringe |

234 mg intramuscularly every 4 weeks |

28-day supply |

|

Invega Sustenna 234 mg/1.5 mL |

1 syringe |

234 mg intramuscularly every month |

30-day supply |

|

Humira 40 mg |

2 pens |

40 mg every other week |

28-day supply |

|

Enbrel 50 mg |

3.92 mL (4 pens) |

50 mg subcutaneously once a week |

28-day supply |

|

Methotrexate 2.5 mg |

32 tablets |

8 tablets on the same day each week |

28-day supply |

When audits are performed, discrepancies in the 28-day vs. 30-day supply are typically educational if there are no early refills or overbilled quantities. However, Humana imposes a $5.00 administrative fee (per refill) to correct any invalid educational days’ supply.

MGMT Tips:

- Always bill the precise days’ supply based on the quantity and directions provided. Contact the physician if any information is missing to ensure you are submitting a valid claim.

- Do not assume the days’ supply field on an electronic prescription is correct, as it is often defaulted.

- Ensure that the frequency on the prescription matches the instructions on the patient label.

- Prescriptions ordered once weekly should be billed as a 28-day supply, while those ordered once monthly should be billed as a 30-day supply.

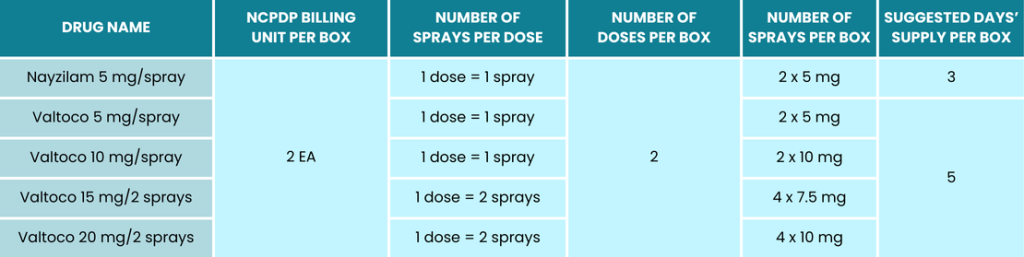

Filling and Billing Tips Proper Billing of Nayzilam® and Valtoco® Nasal Sprays

Some patients with epilepsy experience seizure clusters despite being on maintenance medications. Nayzilam and Valtoco are FDA-approved for the “acute treatment of intermittent, stereotypic episodes of frequent seizure activity (i.e., seizure clusters, acute repetitive seizures) that are distinct from a patient’s usual seizure pattern” for patients 12 years and older and 6 years and older, respectively. However, billing for Nayzilam and Valtoco can be complex, allowing PBMs to easily recoup funds if not done correctly.

Steps for Proper Billing:

- Verify Prescription Details:

- Ensure the prescription has clear directions and the correct quantity prescribed.

- Dosage Instructions:

- Nayzilam:

- Initial dose: One spray into one nostril.

- If needed, and if directions support, an additional spray may be administered into the opposite nostril 10 minutes after the initial dose if the patient does not respond.

- Valtoco:

- The number of sprays per dose depends on the prescribed strength.

- For 5 mg and 10 mg strengths: One spray into one nostril.

- For 15 mg and 20 mg strengths: Two sprays (one into each nostril).

- If needed, and if directions support, a second dose may be administered at least 4 hours after the initial dose if the patient does not respond.

- Nayzilam:

- Calculate Days’ Supply:

- Determine the maximum number of episodes the patient is allowed to treat per month to accurately calculate the days’ supply.

- Nayzilam:

- No more than two doses should be used to treat a single episode.

- It should not be used to treat more than one episode every three days, with a maximum of five episodes per month.

- Valtoco:

- No more than two doses should be used to treat a single episode.

- It should not be used to treat more than one episode every five days, with a maximum of five episodes per month.

Refer to the chart below and MGMT Tips for recommended billing guidance and other necessary prescription components to protect your pharmacy from audit recoupments.

MGMT Tips:

- If any clarifications are needed regarding the directions, include a full clinical note. This should include the date, the name and title of the person you spoke with, the details of the communication, and your initials.

- Ensure that both the quantity and unit of measure are clearly indicated on the prescription. For example, “2 boxes” and “2 EA” will result in different billing outcomes.

- Record the number of episodes the patient will be treating per month to ensure accurate billing and usage, paying close attention to refill intervals.

- Nayzilam and Valtoco are both classified as C-IV controlled substances, requiring all elements of a valid controlled substance prescription on the hard copy. This includes the patient’s address, the physician’s address, and the physician’s DEA number.

Medicare Part B/DMEPOS 2024 DMEPOS: Urological Supplies (Intermittent Catheters)

Many pharmacies struggle with DMEPOS audits due to the complexity of medical billing and the stringent documentation requirements. Medicare Part B suppliers must be able to produce all required documentation if audited, ensuring it meets Medicare Part B standards. This DMEPOS series aims to help you navigate these complexities and gather the necessary documents.

Key Documentation for Audits Involving Intermittent Catheters:

- Standard Written Order (SWO)

- Medical Records:

- The beneficiary must have permanent urinary incontinence or retention.

- “Permanent” is defined as a long and indefinite duration of at least three months.

- The impairment is not expected to be surgically or medically corrected within three months.

- Urological supplies are an exception to requiring proof of continued need. Once the initial medical need is established, ongoing need is assumed due to the permanent condition.

- Proof of Delivery

- Proof of Refill Request and Affirmative Response:

- Required if supplies are delivered or mailed.

Coverage Criteria for Intermittent Catheterization:

- The beneficiary or caregiver must be able to perform the procedure.

- For each episode, Medicare will cover:

- One catheter: A4351 (straight tip) or A4352 (coudé or curved tip), and an individual pack of sterile lubricant A4332, OR

- One sterile intermittent catheter kit: A4353.

Sterile intermittent catheters must meet at least one of the following requirements:

- The patient is a nursing facility resident.

- The patient is immunosuppressed.

- The patient has radiologically documented vesico-ureteral reflux.

- The patient is a pregnant female with spinal cord injury and neurogenic bladder (coverage is for the duration of pregnancy only).

- The patient has had at least two urinary tract infections (UTIs) within 12 months while using A4351/A4352 and sterile lubricant A4332.

Maximum Quantity Allowance:

- Up to 200 intermittent catheterization supplies per month for codes A4332, A4351, A4352, and A4353.

By understanding and adhering to these guidelines, you can better manage your DMEPOS audits and ensure compliance with Medicare Part B requirements.

MGMT Tips:

- The medical necessity for coudé (curved-tip) catheters must be substantiated by documentation in the medical record. The use of coudé tip catheters, particularly for female patients, is seldom deemed reasonable and necessary.

- Review documentation checklist for Jurisdiction A and D

- Review documentation checklist for Jurisdiction B and C

- Review the Urological Supplies LCD and Policy Article